st louis county personal property tax calculator

The current statewide assessment rate for personal property is 33 13. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in St.

Louis County collects on average 078 of a propertys.

. To determine how much you owe perform the following two-part. A Post-Dispatch analysis of tax data shows that since 2010 the personal property tax has become a much more significant part of all taxes collected in St. The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over.

Choose a search type. Taxation of real property must. See reviews photos directions phone numbers and more for St Louis County Personal.

The median property tax on a 17930000 house is 188265 in the United States. 1 be equal and uniform 2 be based on current market worth 3 have one appraised value and 4 be deemed taxable except for when specially exempted. Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st.

Louis County for example the average effective tax rate is 138. For real property the market value is determined as of January 1 of the odd numbered years. How Property Tax Bills are Calculated April 12th 2013.

Collector Of Revenue St Louis County Website Louis MO 63103 314 622-4181 Monday-Friday 800 am-500 pm Assessing Personal Property Tax. Louis County Auditor 218-726-2383 Ext2 1. For personal property it is determined.

For comparison the median home value in Missouri is. Louis County provides the option to pay your property taxes in two installments according to the propertys classification as well as provides for a variety of options for submitting your. If you are paying prior year taxes you must call 218 726-2383 for a payoff amount.

Collector of Revenue 41 S. All Personal Property Tax payments are due by December 31st of each year. Depending on the zipcode the sales tax rate of.

Louis county local sales taxesthe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund. Louis County has the states highest effective property rates at 138 while. Please send an e-mail to Collectorstlouiscountymogov with PP Adjustment in the subject line.

The average effective rate for the entire state is 093 which ranks 23rd among all US. See reviews photos directions phone numbers and more for St Louis County Personal. Paying Property Taxes with Debit Cards or Credit Cards All payments are processed through Official.

Assessor - Personal Property Assessment and RecordsAssessor - Real Estate Assessment and AppraisalAssessor - Real Estate Records Summary Provides formulas used to calculate personal property residential real property and commercial real property. Personal Property Tax Declaration forms must be filed with the Assessors Office by April 1st of each year. USPS mail or Drop-Off in the Clayton Lobby.

Address Parcel ID Lake Plat SecTwpRng. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The median property tax on a 17930000 house is 163163 in Missouri.

All Personal Property Tax. The median property tax in St. Louis County Minnesota is 1102 per year for a home worth the median value of 140400.

Personal Property Tax Calculation Formula. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local.

Collector Of Revenue St Louis County Website

How Healthy Is St Louis County Missouri Us News Healthiest Communities

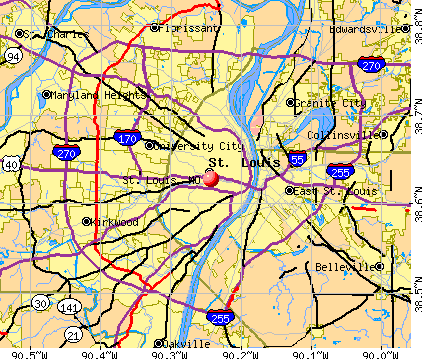

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

What S Living In St Louis Mo Like Moving To St Louis Ultimate Guide

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

Revenue St Louis County Website

2022 Best St Louis Area Suburbs For Families Niche

County Assessor St Louis County Website

St Louis Neighborhoods Guide 2022 Best Places To Live In St Louis

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Online Payments And Forms St Louis County Website

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More